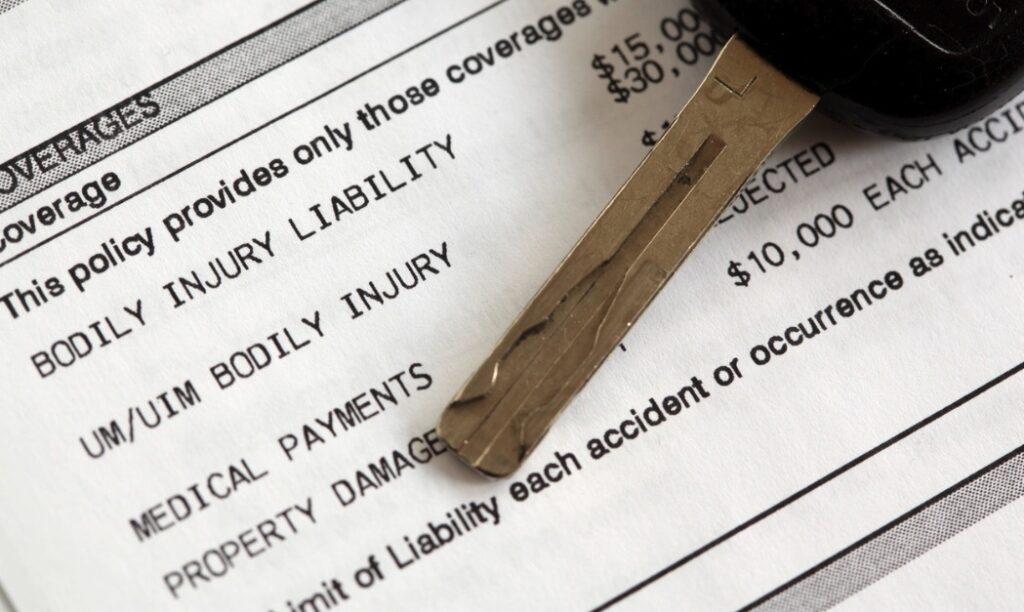

California Insurance Verification – Navigating the world of insurance can be a daunting task, especially in a state as dynamic as California. With so many options and regulations, having a clear understanding of insurance verification is essential.

So, what is insurance verification[1], and why is it crucial? This article will explore everything you need to know about California insurance verification, ensuring you’re well-informed and ready to tackle any insurance-related challenges.

Understanding California Insurance Verification

Understanding California Insurance Verification is essential for residents to comply with state regulations and avoid legal penalties. In California, insurance verification refers to the process of confirming that individuals carry valid insurance coverage, whether for vehicles, health, or other requirements.

The state mandates minimum levels of insurance, and failing to provide proper verification can result in fines or license suspension. California Insurance Verification Understanding this process involves knowing the specific insurance requirements, regularly checking that coverage is up to date, and using online verification systems to streamline the process and ensure compliance with California insurance laws.

What is Insurance Verification?

At its core, insurance verification is the process of confirming that an individual has a valid insurance policy. This is especially crucial in healthcare settings, where providers need to ensure that patients are covered for the services they receive. California Insurance Verification In California, the verification process helps prevent fraud and ensures that both consumers and providers are protected.

Types of Insurance in California

California offers a wide range of insurance types, including health, auto, home, and business insurance. Each type comes with its own verification process and requirements, making it essential to understand which type of insurance you’re dealing with when verification is needed.

Why is Insurance Verification Important?

Insurance verification is important because it ensures that individuals have the necessary coverage to protect themselves and others in case of accidents, medical emergencies, or other incidents. California Insurance Verification In California, insurance verification helps to confirm that drivers meet the state’s minimum liability insurance requirements, which is essential for legal driving and financial protection.

It also applies to healthcare, ensuring that patients are eligible for services and preventing fraud or claim rejections. Proper insurance verification safeguards both the policyholder and service providers from unexpected costs and legal issues, promoting a system of trust and accountability.

Protecting Against Fraud

One of the primary reasons for insurance verification is to protect against fraudulent activities. By confirming coverage, insurers can reduce the risk of scams that could otherwise lead to significant financial losses.

Ensuring Coverage and Compliance

Insurance verification also ensures that all parties involved are compliant with state regulations. California Insurance Verification For example, health providers must verify insurance before rendering services to avoid billing issues later.

The Insurance Verification Process

Steps Involved in Insurance Verification

The insurance verification process typically involves several steps:

- Gathering Information: Collect necessary details like the policyholder’s name, insurance policy number, and dates of coverage.

- Contacting the Insurer: Reach out to the insurance company via phone or online platforms to confirm the policy’s validity.

- Documenting Results: Record the verification outcome for future reference.

Required Documents for Verification

Common documents needed for verification include:

- Insurance card

- Policy documents

- Identification (like a driver’s license)

Insurance Verification in California: Key Laws and Regulations

Insurance Verification in California is governed by key laws and regulations that ensure compliance and protect residents. For vehicle insurance, California mandates minimum liability coverage, which drivers must verify with the Department of Motor Vehicles (DMV).

Failing to provide valid proof of insurance can result in fines, registration suspension, or impounding of the vehicle. In the healthcare sector, insurance verification is required to confirm eligibility for medical services, ensuring that both providers and patients meet coverage standards. California Insurance Verification Adhering to these regulations helps maintain safety, reduce fraud, and ensure that individuals are financially protected in case of accidents or health emergencies.

California’s Insurance Code Overview

California’s insurance laws are designed to protect consumers while ensuring a fair market for providers. These regulations dictate how verification must be conducted, particularly regarding healthcare.

Consumer Protections in Insurance Verification

The state has implemented numerous consumer protection measures, ensuring that individuals are treated fairly during the verification process. This includes restrictions on how insurers can communicate and share information.

How to Verify Insurance in California

Online Verification Tools

Many insurance companies offer online portals where policyholders can verify their coverage easily. This method is often the quickest and most efficient.

Contacting Insurance Providers Directly

For those who prefer a more personal touch, calling the insurance provider directly can provide immediate answers. Make sure to have all necessary information on hand to streamline the process.

Common Challenges in Insurance Verification

Issues with Incomplete Information

One common hurdle is dealing with incomplete information. Sometimes, policyholders may not provide all necessary details, leading to delays in verification.

Difficulties with Provider Response Times

Additionally, insurance providers may take longer than expected to respond, particularly during peak times. Patience is key, but knowing your rights can empower you to follow up effectively.

The Role of Technology in Insurance Verification

Advancements in Digital Verification

Technology has significantly streamlined the insurance verification process. Many insurers now use automated systems that can quickly confirm coverage without human intervention.

Benefits of Automated Systems

These systems not only improve efficiency but also reduce errors, ensuring that both consumers and providers have access to accurate information promptly.

Best Practices for Insurance Verification

California Insurance Verification is a crucial process to ensure that individuals meet the state’s insurance requirements, particularly for vehicles and healthcare. In California, insurance verification involves confirming that the coverage complies with state laws, such as minimum liability for car insurance or health coverage mandates.

Insurance verification helps to prevent fraud and maintain compliance, ensuring that residents are adequately protected in case of accidents or other incidents. Following best practices for California Insurance Verification includes regularly updating policy information, using reliable verification tools, and promptly addressing any gaps in coverage to avoid penalties or legal issues.

Tips for Effective Verification

- Always Double-Check: Ensure that the information you have is complete and accurate before starting the verification process.

- Keep Records: Document all communications with insurance providers for future reference.

Avoiding Common Mistakes

Avoid common pitfalls, such as neglecting to follow up or not verifying coverage before receiving services.

Conclusion

Insurance verification is a vital process that protects both consumers and providers in California. By understanding its importance and following the necessary steps, you can ensure that you and your loved ones are adequately covered, minimizing any potential issues down the line.

FAQs About California Insurance Verification

What information is needed for insurance verification?

Typically, you’ll need the policyholder’s name, policy number, and the effective dates of coverage.

How often should insurance be verified?

It’s best to verify insurance before receiving any significant services or once a year for routine checks.

Can insurance be verified without a policy number?

While a policy number is helpful, many providers can verify coverage using other details, such as the policyholder’s name and date of birth.

What should I do if my insurance provider is unresponsive?

If your provider is slow to respond, try contacting them through multiple channels, such as phone, email, or online chat.

Are there any fees associated with insurance verification?

Most insurance verification processes are free, but some specialized services might charge a fee.

Reference